Step-by-Step Guide to Filing North Carolina Sales Tax (Form E-500) Using Shopify

If you’re a North Carolina-based business or a remote seller with taxable sales in the state, you’re required to file your sales tax using the E-500 form.

If you’re a North Carolina-based business or a remote seller with taxable sales in the state, you’re required to file your sales tax using the E-500 form. This guide will walk you through the process of gathering the necessary data from Shopify, preparing your sales data, and filing the E-500 form through North Carolina’s online tax portal. This is just a guide, so please make sure you are asking an expert if you aren't sure of yourself when filing.

Step 1: Gather Your Sales Data from Shopify

- In your Shopify admin dashboard, navigate to Analytics > Reports > United States Sales Tax.

- Filter the report for the North Carolina filing period you are submitting for (monthly, quarterly, etc.).

- Export the report as a CSV file, then open it in Google Sheets to organize and sort the sales data as needed.

Step 2: Log into Your North Carolina Taxpayer Account

- Visit the North Carolina Department of Revenue portal at: https://eservices.dor.nc.gov/sau/contact.jsp.

- Log in using your taxpayer credentials.

- Select the filing period for which you need to file, and begin the return.

Step 3: Complete the E-500 Form

- Zero Tax Due:

- If you have no taxable sales for the period, simply check the box for Zero Tax Due.

- Line 1: Total Gross Sales:

- Enter your total gross sales from the Shopify report in this field.

- Line 2: Wholesale Transactions:

- If applicable, enter the total amount for wholesale transactions that are not subject to sales tax.

- Line 3: Exemptions:

- Enter the total for exempt sales, such as exempted product categories or customer types.

- Line 4: Sales Subject to General State Rate:

- For sales subject to the general state tax rate, enter the total taxable sales here.

- Line 5: Reduced State Rate (3%):

- If any sales were taxed at the reduced 3% state rate, report the total gross sales in this line.

Step 4: Enter Local County Sales Data

- Sort by Rate: In your Google Sheet from Shopify, sort your sales by the various county tax rates.

- Group your sales by the different rates, such as:

- 2.25% county rate.

- 2.0% county rate.

- 0.5% county rate.

- 0.25% transit county rate.

- Group your sales by the different rates, such as:

- Gross Sales: Enter the total gross sales for each rate into the appropriate sections on this page.

Step 5: Confirm Local Tax Amounts

- On the next page, you will be prompted to enter the tax amounts, not the gross sales.

- The system will confirm that your tax amounts match the gross sales data entered on the first page of the E-500.

Step 6: Finalize and Submit

- Review your entries to ensure all the numbers align with your Shopify report and Google Sheet.

- Select your payment method and confirm your submission.

- Save or print a copy of your filing for your records.

Additional Notes:

- E-500 Form: The E-500 is the form used for reporting sales tax in North Carolina. Make sure to reference it when filing and ensure the form is filled out accurately.

- Local Sales: Double-check your local tax rates and ensure you’ve entered the correct figures for each county rate.

By following these steps, you’ll be able to accurately file your North Carolina sales tax using the E-500 form, based on your Shopify sales data.

Delighted customers

Real merchants. Real support.

Real results.

Continue reading

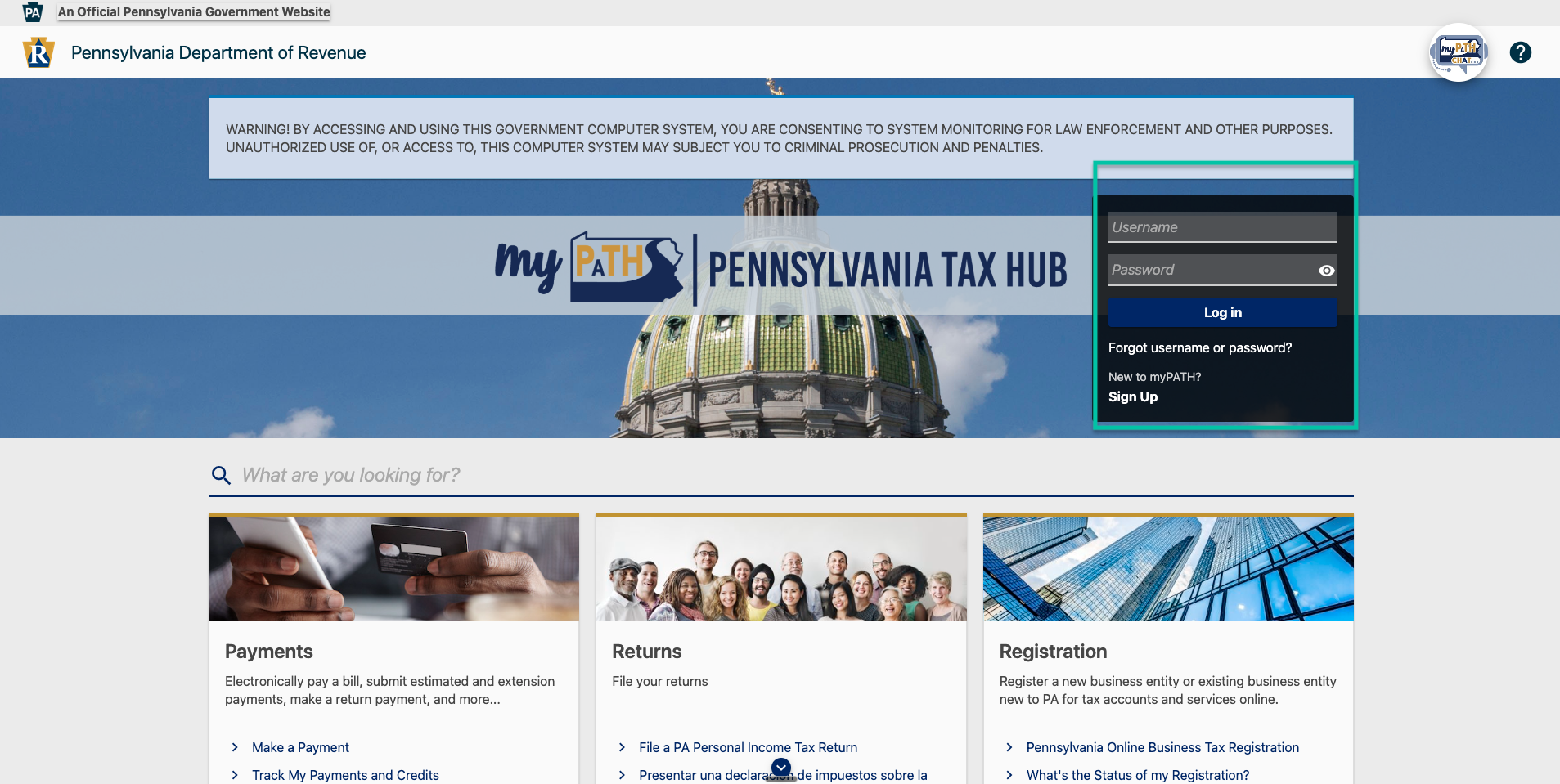

How to Add an Email as a 2FA option on Pennsylvania's Sales Tax Portal

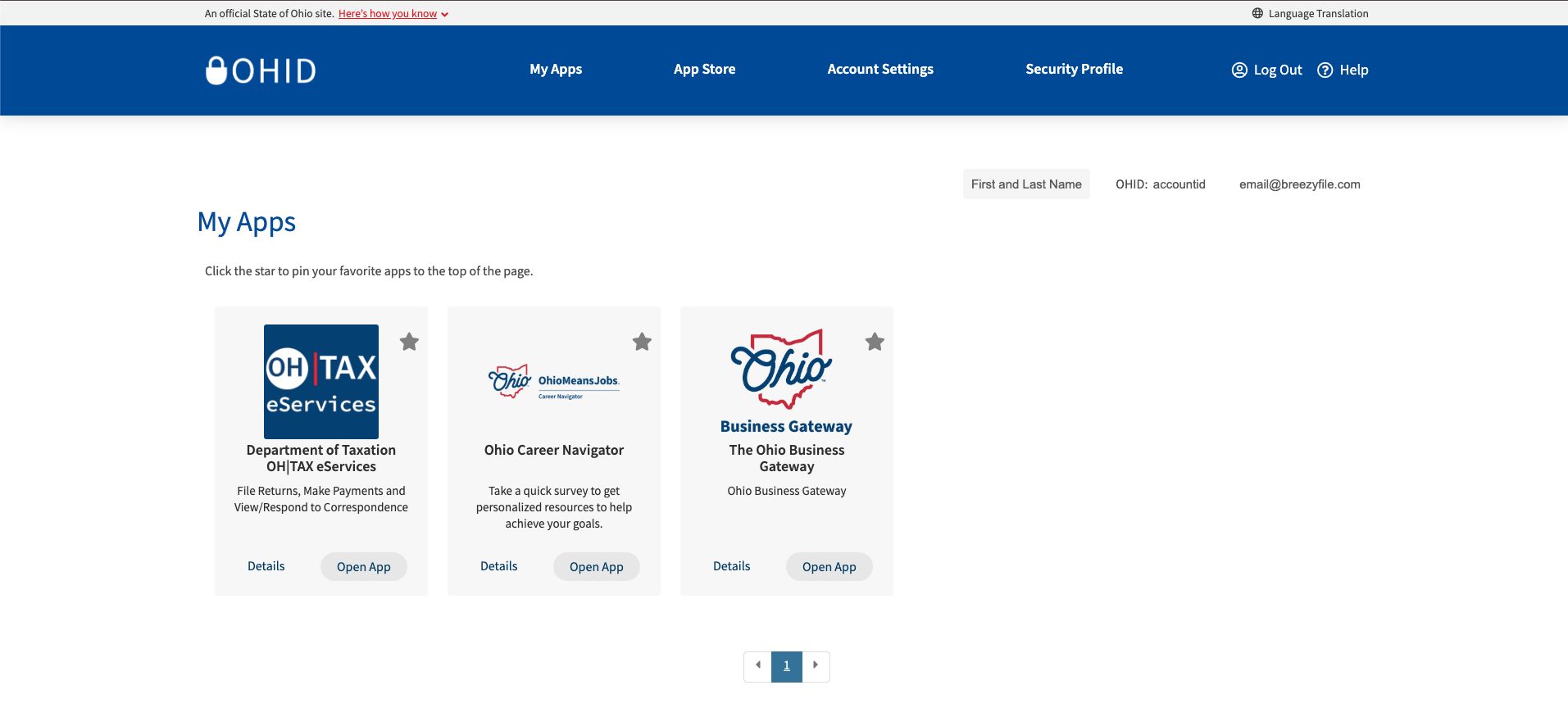

How to Add an Email as a 2FA Option on Ohio’s Sales Tax Portal

Ready to

stop stressing

about sales tax?

BreezyFile makes filings and registrations simple, accurate, and fully automated inside Shopify. Try it and see how easy compliance can be.